Nigerians Don’t Know Their Tax Rights – Bishop Isong

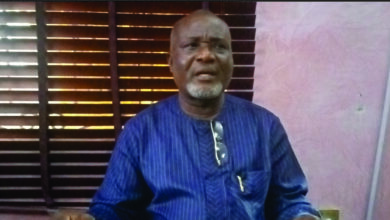

Bishop Emmah Gospel Isong is a man of many parts. He is the current chairman of Cross River State Anti-Tax Agency; national publicity secretary of Pentecostal Fellowship of Nigeria( PFN) as well as founder and president of Christian Central Chapel International( CCIC), Calabar.

Isong, a trained banker and finance expert, has also been involved in anti-corruption crusade with the United States Consulate, with commitment to helping the poor.

In this interview conducted by Etim Bassey, the Crystal Express anchor-man in Calabar, the cleric spoke on issues ranging from their plans for the poor, tax exemption, the challenges the tax agency is facing, the way out and why government policies fail as well as their commitment to delivering on their mandate.

Excerpts:

Two months ago, the Cross River State Government set up the Anti-Tax Agency aimed at ameliorating the plight of the poor. How far has the Agency gone in prosecuting their mandate?

This is a novel agency that has never been found anywhere in Africa. The first time an agency is set up just to protect the poor and members of the public, indigenes and non-indigenes alike. We were inaugurated on May 20, 2020 and we are made up of four clergymen and a woman. Our mandate is to ensure that the tricycle (Keke) riders, taxi drivers, disabled people, low income earners, small shops including hotels (one star hotels) are exempted from tax not only as an executive fiat but in line with the 2015 law of the state which was legislated and passed.

It is a laudable project for a politician like Professor Ben Ayade of Cross River State to embark upon. It’s a socialist aspect of political science and for political engineering of the state. It is part of Ayade’s COVID-19 incentives by giving not only tax holidays, but tax exemptions to the poorest of the poor. So it has been a wonderful journey being that I am the first chairman of that agency. Nobody handed over to me; neither did I meet any foundation on ground, no documents.

So far, we have gone far in partnership with the House of Assembly to amend the 2015 law which was never executed; we have also liaised with the judiciary. The acting chief judge, Justice Maurice Eneji, has graciously approved mobile court for the anti-tax agency. Besides, the commissioner for local government, in conjunction with the 18 newly-inaugurated local government chairmen has agreed to partner us to curb this menace of illegal and multiple taxations in the state.

What are the greatest challenges you are facing in the course of your assignment?

The greatest challenge I am facing now is what I will come up with in a book in the future. Having been in government for only two months, I now understood why government has problems, the lacklustre, the lack of ease in doing business and the reason government has no business in business. I have discovered intricacies of political interests, even in matters that have to do with public interest. I have noticed the lack of inter-ministerial cooperation and that of ministries, departments and agencies (MDAs). I have discovered that our basic problem is that in government if funds are approved to you, to receive it, I think your grandfather must resurrect from the grave. Furthermore, I have discovered that while pursuing government policies, you drive like a driver with a brand new car but on a bad road; you are now like a driver who is to either hit an old woman or a little baby. Who will you advise the driver to hit?

I am speaking in proverbs because you notice that even when elections are over, politics continues in governance, which is not supposed to be so. Those who implement government policies personalise their contributions and so there is a high level of suspicion in very laudable government policies like the anti-tax policies. For instance a lot of politicians, I can say this very loud, own revenue points and they are the ones you still go to, to help you approve funds. So you are fighting a corrupt system that has been on for years despite the good intentions of the governor, who in his innocence does not really recognise these enemies because he has a free-minded disposition.

Those of us who are players, especially the new ones, we have noticed that the players of the system are the enemies of the system. Sometimes you are warned by many to slow down because what you see is not what you should take. So that is the scenario that is keeping us where we are now. I am hoping that this is just a training ground for me. So in summary, those are the challenges we are facing.

So what ought to be done in this regard?

I think one Nigerian may not be enough to correct what we are seeing around. Just choosing a leader or electing a councillor or a senator is not enough. Nigeria will continue to play this game for a thousand years until we come back to the discussion of how government can work. The workability and functionality of governmental policies which have genuine intentions of changing the lives of the critical mass of the people should be paramount to all of us.

Considering the fact that most of the members of the agency are clerics and considering the enormity of the challenges, do you think the agency can break through and ensure that tax relief is actually implemented in the state?

Yes and no! Yes because the Anti-Tax Agency can break through and ensure tax relief because the four gentlemen of the clergy are very zealous, passionate, united and working together to ensure that we interpret government policies as it were. But no in the sense that your good intentions are not enough for nefarious inventions opposing your good intentions. So you come out to do good but the people around you, who pay the piper, dictate the tune. Therefore, if he who pays the piper dictates the tune, then those who dance to the tune of the piper notice that the piper is not piping the best of the tune they expected him to pipe, they should not blame the piper but look behind the players and those who hired the piper. I will speak in proverbs.

Do you suggest that the anti-tax agency should be taken to the federal level?

Many governments are already copying us, so that is why we must be on the speed lane. Akwa Ibom State has just announced plans for tax exemptions. Don’t forget that Professor Ayade is always setting the pace and people are always copying. But the question is not setting the pace but also sustaining the pace. You may set the pace but a lot of intricacies will delay the pace. So Cross River State will always set the pace but we must deploy the best of our energies in finances and infrastructure, motivation of the players to maintain the pace and fasten the pace. I will suggest that tax exemption becomes a federal policy even though they are at very nuclear level, very selective and ignorant level. Nigerians don’t even know their tax rights, not to talk of if they were exempted from tax.

How do you combine your new job with your role as a minister of the gospel?

I have been a man of many parts. Don’t forget that by my training in banking and finance, I major in taxation, so this became like a hubby and this also synchronizes with my hubby to help the poor. We have been engaging in the welfare of widows and paying of school fees. So, government asking me to help supervise an agency that does almost the same thing I have been doing over the years is like calling a spade a spade or putting a round peg in a round hole. For me, no qualms and no distractions. The only advantage is that you are given governmental backing to back up a vision. You may have a vision for ever but no platform to stand. I appreciate our digital governor, Sir Professor Ben Ayade, for giving me and others the platform to stand and do same thing we have been doing over the years.